Camelot Exchange: Pioneering the Future of Decentralized Trading

Introduction

As the decentralized finance (DeFi) landscape continues to evolve, the demand for innovative trading platforms has surged. Among the burgeoning platforms is Camelot Exchange, which aims to provide users with a seamless and efficient trading experience in the decentralized space. This article delves into the features, benefits, challenges, and future potential of Camelot Exchange, highlighting its role in the broader DeFi ecosystem.

What is Camelot Exchange?

Overview

Camelot Exchange is a decentralized exchange (DEX) built on the Arbitrum network, designed to facilitate the trading of cryptocurrencies and assets in a secure and user-friendly environment. Utilizing automated market maker (AMM) technology, Camelot allows users to trade directly from their wallets without the need for intermediaries, ensuring greater control over their assets.

Vision and Mission

The vision behind Camelot Exchange is to create a robust trading platform that empowers users by providing them with the tools and resources they need to engage in DeFi. Its mission is to promote financial inclusivity and transparency within the cryptocurrency space, enabling users to trade with confidence.

Key Features of Camelot Exchange

1. Automated Market Maker (AMM) Model

Camelot Exchange employs an AMM model, which allows users to provide liquidity to trading pairs and earn rewards. This model eliminates the need for order books and enables users to trade directly against liquidity pools, ensuring efficient price discovery and reduced slippage.

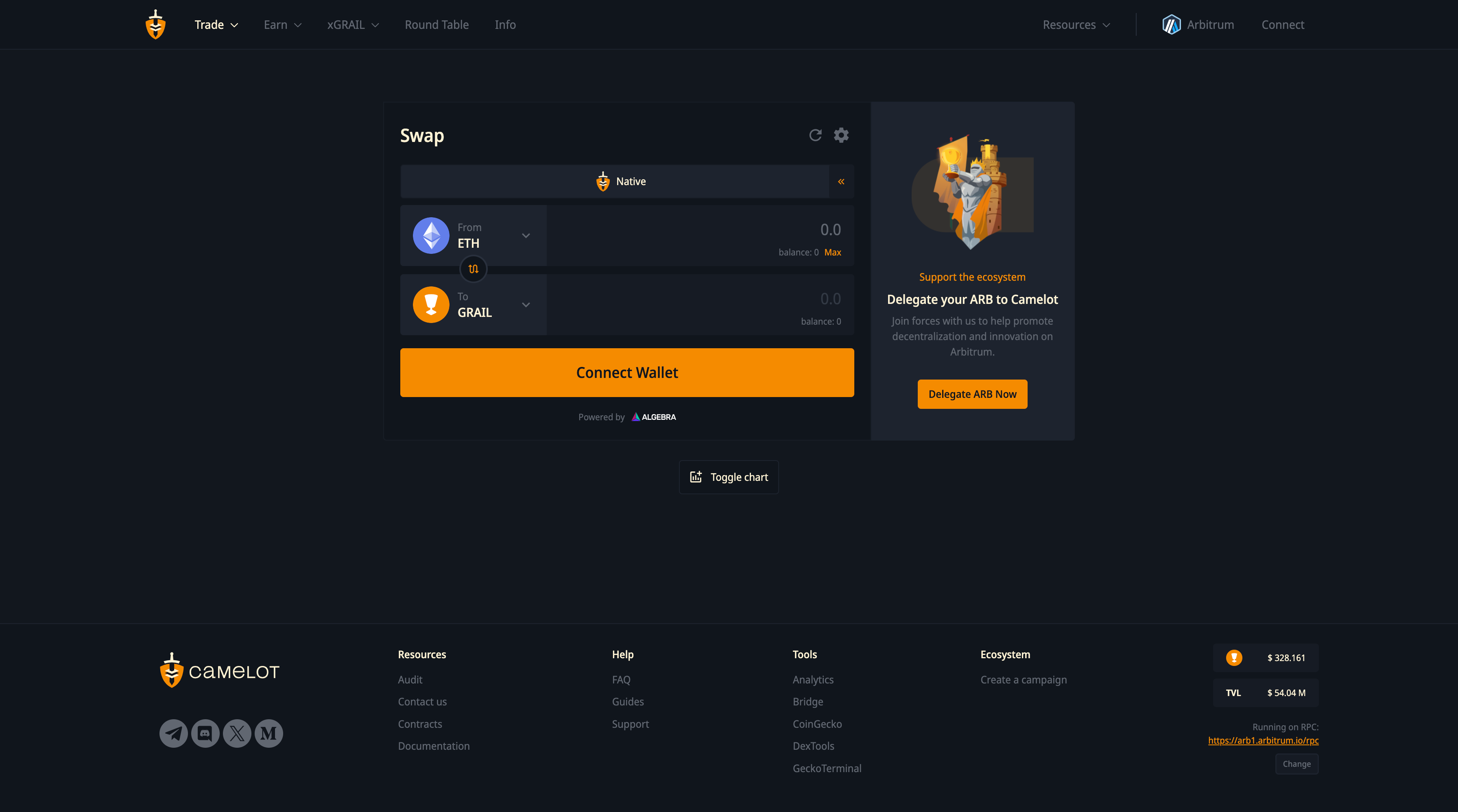

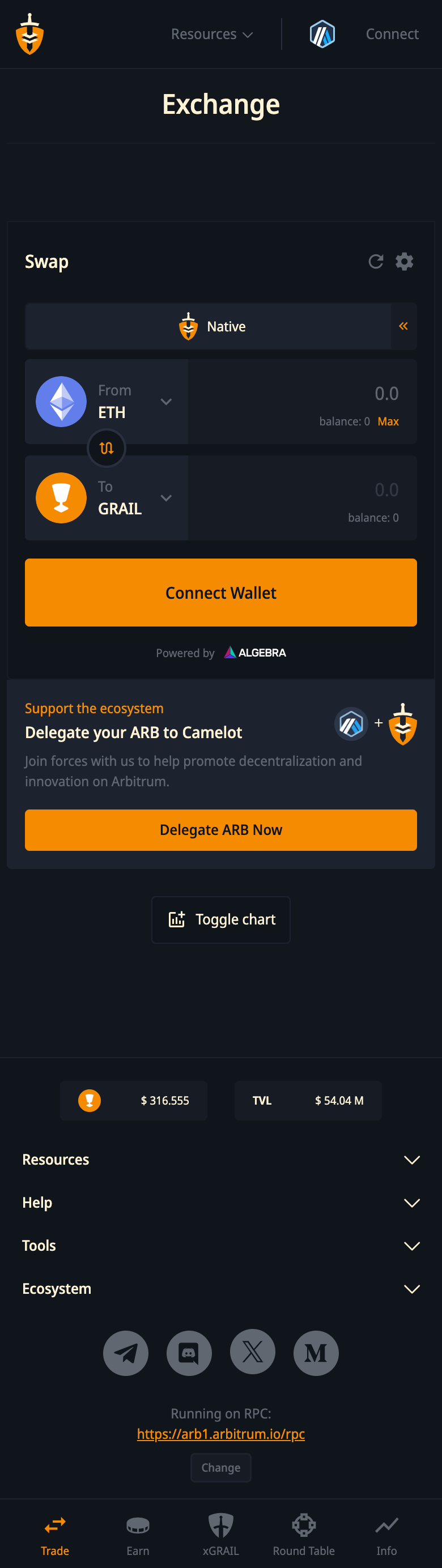

2. User-Friendly Interface

The platform is designed with a focus on user experience, featuring an intuitive interface that simplifies navigation for both novice and experienced traders. Users can easily access trading pairs, liquidity pools, and analytics tools without being overwhelmed by complex functionalities.

3. Low Transaction Fees

Camelot Exchange benefits from the Arbitrum network's scalability, resulting in low transaction fees for users. This cost-effectiveness makes it an attractive option for traders looking to minimize their trading costs.

4. Cross-Chain Compatibility

One of Camelot’s standout features is its cross-chain compatibility, allowing users to trade assets from different blockchain networks. This interoperability expands the range of available trading pairs and enhances liquidity across the platform.

5. Liquidity Pools and Yield Farming

Users can participate in liquidity pools by depositing their assets, earning rewards in the form of transaction fees and platform tokens. Camelot also offers yield farming opportunities, allowing users to stake their tokens for additional rewards.

6. Governance Token

Camelot Exchange has a native governance token, which enables holders to participate in the decision-making process for the platform’s development. This community-driven approach fosters engagement and ensures that users have a say in the platform's future direction.

7. Security Measures

Security is a top priority for Camelot Exchange. The platform employs robust security protocols, including smart contract audits and multi-signature wallets, to protect users' funds and enhance trust within the ecosystem.

8. Educational Resources

Camelot Exchange is committed to educating its users about DeFi and trading strategies. The platform offers a variety of resources, including tutorials, guides, and webinars, to empower users to make informed decisions.

Benefits of Camelot Exchange

1. Greater Control Over Assets

By utilizing a decentralized exchange model, Camelot allows users to retain full control over their assets. Traders can execute transactions directly from their wallets, minimizing the risks associated with centralized exchanges.

2. Enhanced Privacy

Camelot Exchange prioritizes user privacy, requiring minimal personal information for trading. This anonymity is appealing to users who value their privacy and wish to safeguard their financial data.

3. Increased Liquidity

The platform’s liquidity pools and yield farming opportunities attract liquidity providers, enhancing the overall liquidity of the exchange. This increased liquidity leads to better pricing and reduced slippage for traders.

4. Cost-Effective Trading

With low transaction fees and no hidden costs, Camelot Exchange makes trading more accessible for users. This cost-effectiveness is particularly beneficial for smaller traders looking to maximize their returns.

5. Community Engagement

The governance token allows users to participate in important decisions regarding the platform’s development. This community-driven approach fosters a sense of ownership and engagement among users.

Use Cases for Camelot Exchange

1. Cryptocurrency Trading

Camelot Exchange enables users to trade a wide variety of cryptocurrencies in a decentralized manner. Traders can access multiple trading pairs and execute transactions without the need for intermediaries.

2. Liquidity Provision

Users can provide liquidity to various trading pairs, earning rewards in return. This not only benefits the liquidity providers but also enhances the overall trading experience for all users on the platform.

3. Yield Farming

Camelot Exchange offers yield farming opportunities, allowing users to stake their tokens in liquidity pools and earn additional rewards. This feature incentivizes long-term engagement with the platform.

4. Cross-Chain Transactions

The platform's cross-chain compatibility allows users to trade assets from different blockchain networks, increasing the range of available trading pairs and enhancing liquidity.

5. Educational Initiatives

Camelot Exchange can serve as a valuable resource for users seeking to learn about DeFi and trading strategies. The platform’s educational resources empower users to make informed decisions and enhance their trading skills.

Challenges and Considerations

1. Market Volatility

Cryptocurrency markets are inherently volatile, and users must be prepared for rapid price fluctuations. Traders on Camelot Exchange should conduct thorough research and employ risk management strategies.

2. Regulatory Scrutiny

As the DeFi space continues to grow, regulatory scrutiny is likely to increase. Camelot Exchange must navigate the evolving regulatory landscape while ensuring compliance with relevant laws and regulations.

3. Competition

The decentralized exchange market is highly competitive, with numerous platforms vying for attention. Camelot Exchange must continuously innovate and differentiate itself to attract and retain users.

4. Technical Complexity

While Camelot aims to provide a user-friendly experience, some users may still find the technical aspects of decentralized trading challenging. Continuous efforts to improve user education and support are essential for effectively onboarding new traders.

The Future of Camelot Exchange

1. Expanding Asset Support

To enhance its offerings, Camelot Exchange aims to expand its support for additional cryptocurrencies and tokens. This will provide users with more trading options and investment opportunities.

2. Enhancing User Experience

Camelot Exchange will continue to prioritize user experience by implementing new features and improvements based on user feedback. This includes simplifying processes, enhancing the interface, and providing additional educational resources.

3. Strengthening Community Governance

As the platform grows, Camelot Exchange plans to strengthen its governance model by introducing more robust voting mechanisms and encouraging active participation from the community. This ensures that users have a meaningful voice in shaping the platform's future.

4. Exploring New Financial Products

Camelot Exchange may explore the development of new financial products and services, such as lending and borrowing options, to diversify its offerings and attract a wider range of users.

5. Commitment to Security

Camelot Exchange will continue to prioritize security by conducting regular audits, implementing best practices, and staying up to date with the latest advancements in blockchain security.

Conclusion

Camelot Exchange represents a significant advancement in the decentralized finance landscape, offering a robust and innovative trading platform for cryptocurrency enthusiasts. With its user-friendly interface, low transaction fees, and commitment to security, Camelot Exchange is well-positioned to attract a diverse range of users.

Camelot Exchange is a decentralized exchange (DEX) built on the Arbitrum network, designed to facilitate the trading of cryptocurrencies and assets in a secure and user-friendly environment. Utilizing automated market maker (AMM) technology, Camelot allows users to trade directly from their wallets without the need for intermediaries, ensuring greater control over their assets.

Made in Typedream